Texas LLC Operating Agreements: Your Lone Star Legal Lowdown

So, you're thinking about starting an LLC in Texas. Big dreams, big hair, big… legal documents? Yep, that’s part of the deal. You’ve probably heard whispers about the "Texas LLC company agreement," that mythical piece of paper that supposedly holds the key to a smooth-running business. Is it really that important? Spoiler alert: it is.

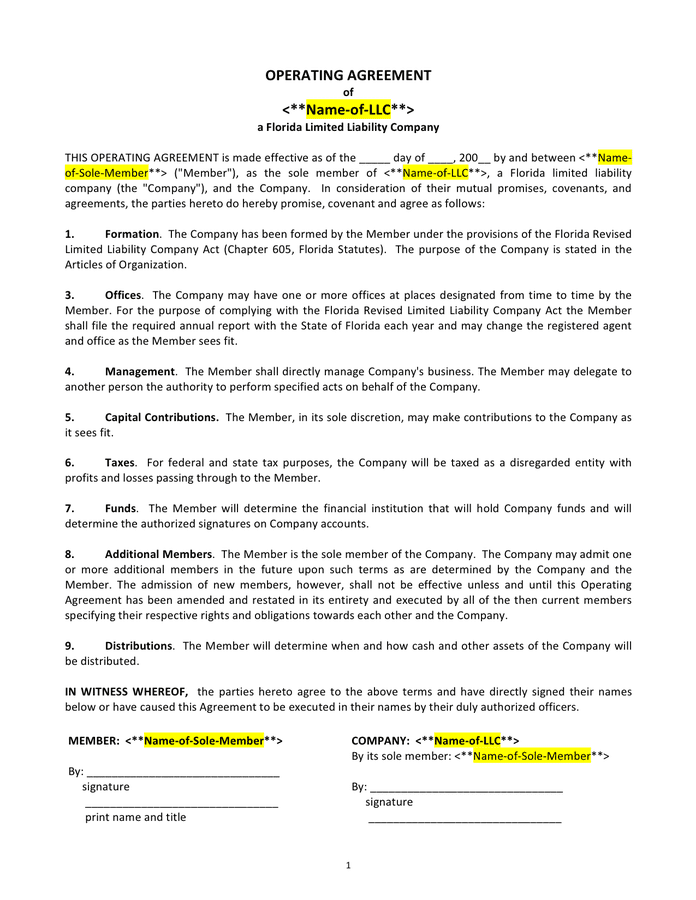

A Texas LLC operating agreement, sometimes called a "company agreement," isn’t just some bureaucratic hoop to jump through. It’s the blueprint for how your LLC will operate. Think of it as a prenup for your business partners—except instead of arguing over who gets the dog, you’re hashing out how profits will be split, who makes decisions, and what happens if someone wants out. Having a well-drafted Texas LLC operating agreement can save you from headaches, lawsuits, and maybe even a few existential crises down the line.

The beauty of a Texas LLC company agreement is its flexibility. Unlike the rigid requirements of corporations, LLC operating agreements can be customized to fit the specific needs of your business. This legal framework, established by the Texas Business Organizations Code, allows members to determine their own rules for management, profit distribution, and even dispute resolution. Essentially, you get to write the rules of your own little business kingdom.

Historically, operating agreements weren’t always given the weight they deserve. But as LLCs gained popularity, so did the understanding that a solid operating agreement is crucial. One of the main issues that arises without a Texas LLC operating agreement is the default to Texas state law. While the default rules might work for some, they might not be ideal for your specific situation. For example, the default rules may dictate an even split of profits, regardless of member contributions. If you and your partners have a different arrangement in mind, a written agreement is essential.

Let's break down what a Texas LLC operating agreement actually is: a legally binding contract among the members of a limited liability company outlining the internal operations and governance of the company. It doesn't need to be filed with the state, which means it remains a private document. This allows for a degree of confidentiality that can be beneficial in certain situations. A simple example: imagine you and your friend start a dog-walking business. Your operating agreement might specify that you handle the marketing while your friend manages scheduling. This seemingly simple detail, if not documented, could lead to confusion and conflict down the road.

One key benefit of a well-crafted Texas LLC operating agreement is its ability to protect your limited liability status. Without a written agreement, a court might be more likely to “pierce the corporate veil,” meaning your personal assets could be at risk if the business incurs debts or faces lawsuits. Another benefit? Clarity. By outlining the roles and responsibilities of each member, the agreement prevents misunderstandings and disagreements. Finally, a comprehensive operating agreement can streamline the process of adding or removing members, selling the business, or dissolving the LLC.

Creating a Texas LLC operating agreement doesn't have to be daunting. You can find numerous templates and resources online, including examples of Texas LLC company agreements tailored to various business structures. While using a template can be a good starting point, it’s important to customize the agreement to reflect your specific circumstances. Consulting with a legal professional can ensure that your agreement is comprehensive and legally sound.

Some best practices for implementing a Texas LLC operating agreement include: clearly defining member contributions and ownership percentages, establishing a detailed process for decision-making, outlining procedures for profit and loss allocation, and addressing potential scenarios such as death, disability, or withdrawal of a member.

Advantages and Disadvantages of a Texas LLC Operating Agreement

| Advantages | Disadvantages |

|---|---|

| Protects Limited Liability | Requires Time and Effort to Create |

| Provides Clarity and Prevents Disputes | Can Be Complex if Not Done Correctly |

| Offers Flexibility in Management Structure | May Require Legal Assistance |

Frequently Asked Questions about Texas LLC Company Agreements:

1. Is an operating agreement required in Texas? No, but it's highly recommended.

2. Where can I find Texas LLC company agreement examples? Online resources and legal professionals can provide examples.

3. Can I modify my operating agreement after it's created? Yes, with the consent of all members.

In conclusion, a Texas LLC company agreement is a vital document for any business operating in the Lone Star State. While not legally mandatory, it offers crucial protection, clarity, and flexibility. From preventing disputes among members to safeguarding your limited liability status, a well-drafted agreement provides a solid legal foundation for your business. Don't just wing it – take the time to create a comprehensive operating agreement. It's an investment in your business's future. Consult with a legal professional and ensure your Texas LLC is set up for success.

Unpacking the cry for me roblox id phenomenon

Gift starbucks delight emailing coffee cheer

Unlocking perfect color mastering paint brand color matching