Navigating Medicare with Blue Cross Blue Shield Plan G

Considering Medicare supplemental insurance? Finding the right plan can feel overwhelming. This exploration of Blue Cross Blue Shield Plan G coverage aims to simplify the complexities, offering a clearer picture of what this plan entails and how it might fit your healthcare needs.

Medicare, while providing crucial coverage, doesn't cover all healthcare expenses. This is where supplemental plans, like Plan G, step in. Blue Cross Blue Shield, a trusted name in insurance, offers Plan G to help bridge the gaps in Original Medicare coverage.

Understanding the details of Blue Cross Blue Shield Plan G coverage is essential for making informed decisions about your healthcare future. This includes understanding what it covers, what it doesn't, and how it compares to other options. It’s about finding the balance between coverage and cost, tailored to your individual requirements.

Navigating the landscape of Medicare supplement insurance requires a focus on the essentials. For many, Plan G from Blue Cross Blue Shield represents a comprehensive approach to covering those expenses Original Medicare leaves behind, offering peace of mind in the face of unexpected medical bills. However, delving into the specifics is crucial.

With the rising costs of healthcare, considering supplemental coverage becomes an increasingly important decision. Blue Cross Blue Shield's Plan G provides a specific set of benefits designed to address those out-of-pocket costs, allowing you to focus on your well-being rather than financial worries.

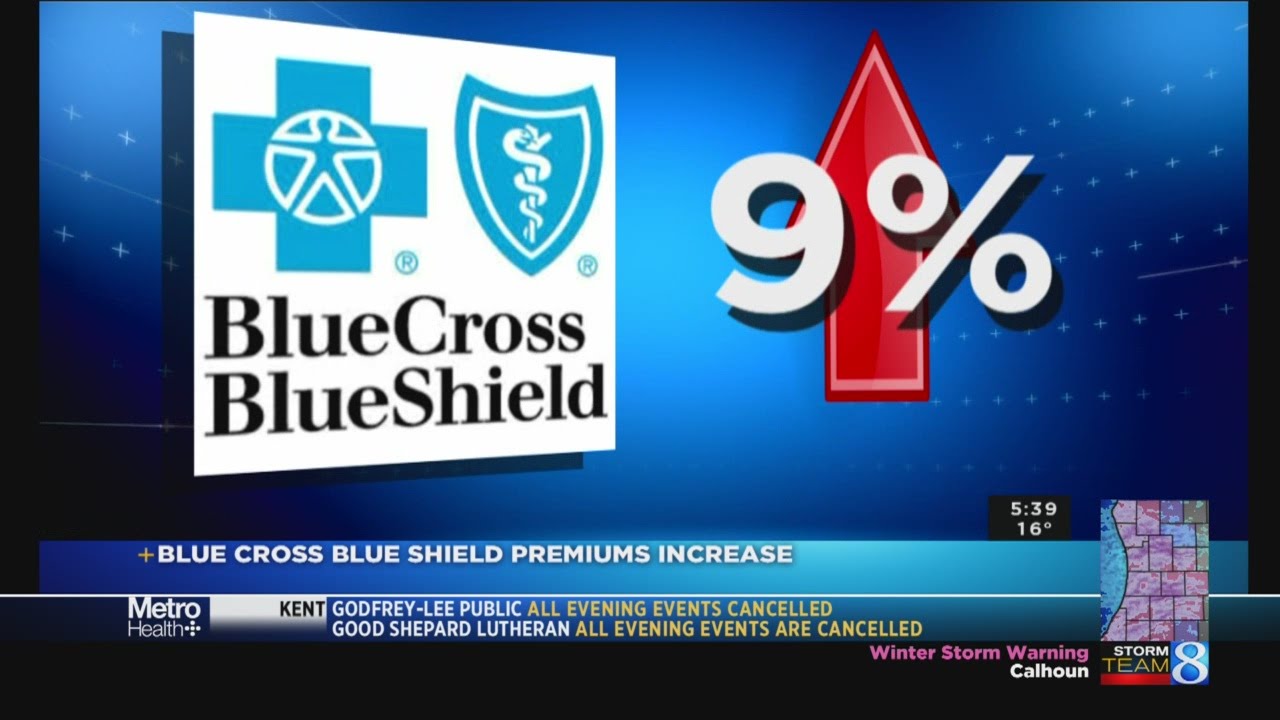

Blue Cross Blue Shield emerged from separate organizations – Blue Cross, covering hospital costs, and Blue Shield, covering physician fees. Over time, they merged to offer comprehensive coverage. Medicare supplemental plans, including Plan G, were standardized to create transparency and ease comparison for beneficiaries. A primary concern regarding Plan G, and other supplemental plans, is the rising cost of premiums over time, highlighting the importance of comparing plans annually.

Blue Cross Blue Shield Plan G is a Medigap policy that helps cover the "gaps" in Original Medicare (Part A and Part B) coverage. It pays for various out-of-pocket expenses, such as copayments, coinsurance, and deductibles. For example, if you have a hospital stay, Plan G would help cover the Part A deductible and coinsurance.

Benefits of BCBS Plan G include predictable healthcare costs due to comprehensive coverage, access to any Medicare-approved doctor or hospital nationwide without referrals, and simplified claims processing as the plan pays directly to providers.

Advantages and Disadvantages of BCBS Plan G

| Advantages | Disadvantages |

|---|---|

| Comprehensive Coverage | Higher Premiums |

| Freedom to Choose Doctors | No Coverage for Part B Excess Charges |

| Predictable Costs | Limited Coverage for Part B Excess Charges |

An action plan for choosing BCBS Plan G involves comparing plans available in your area, reviewing your healthcare needs and budget, and contacting Blue Cross Blue Shield directly or using online resources like Medicare.gov to get quotes and enroll.

Frequently asked questions include: What does Plan G cover? What doesn’t it cover? How much does it cost? How do I enroll? What are the eligibility requirements? Is there an open enrollment period? Can I switch plans later? What are other Medigap options?

Tips for navigating Plan G include: comparing plans annually, understanding your healthcare needs, reviewing your budget, and consulting with a licensed insurance agent if needed.

Choosing a Medicare supplement plan is a significant decision. Blue Cross Blue Shield Plan G offers extensive coverage, protecting you from unexpected medical expenses. While the premiums may be higher than other plans, the comprehensive coverage provides peace of mind, allowing you to focus on your health and well-being. By thoroughly researching and comparing options, you can choose the plan that best aligns with your individual needs and budget. Explore available options, compare quotes, and consider your healthcare priorities to ensure you're making the most informed choice for your future. Don't hesitate to seek advice from trusted resources like Medicare.gov or licensed insurance agents. Taking the time to understand your options empowers you to navigate the complexities of Medicare with greater confidence. Your health and financial security are worthy of careful consideration.

Mastering lug nut torque your guide to wheel safety

Ao smith electric motor replacement your ultimate guide

Dominate your bracket expert picks for tournament success