Mastering Wire Transfers to Wells Fargo: Your Ultimate Guide

Need to send money fast? Wire transfers are a reliable way to move funds electronically, especially for larger sums. This guide focuses on transferring money to Wells Fargo accounts, providing a comprehensive look at the process.

Transferring funds via wire offers a speedy method for moving money directly to a Wells Fargo account. While there are other electronic transfer options, wire transfers remain popular for their speed and security, particularly for substantial amounts.

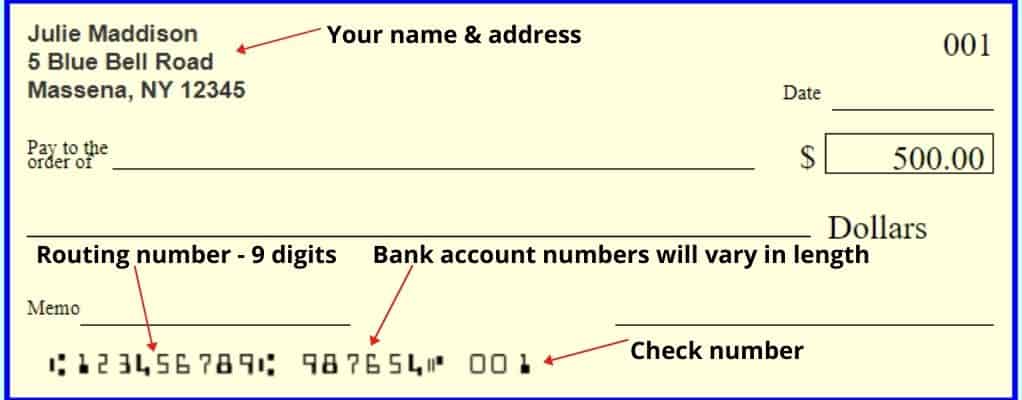

Before initiating a wire transfer to Wells Fargo, it's essential to gather the correct information. Incorrect details can lead to delays or even the funds being sent to the wrong account. Understanding the required information beforehand streamlines the process and minimizes potential problems.

While wire transfers offer speed and security, they typically involve fees. Knowing the associated costs is important for budgeting and ensuring you're aware of the total expense. Fees can vary based on the transfer type (domestic or international) and the method used to initiate the transfer (online, in-person, etc.).

Navigating the world of wire transfers can seem daunting, but with the right information, it can be a straightforward process. This guide will empower you to initiate wire transfers to Wells Fargo with confidence and efficiency. Let's dive into the details.

The history of wire transfers dates back to the 19th century with the invention of the telegraph. Initially used for sending messages, the technology evolved to enable the electronic transfer of funds. Banks adopted this technology to facilitate faster and more secure transactions between accounts. Today, wire transfers remain a vital part of the financial landscape.

A wire transfer is an electronic method of moving money from one financial institution to another. When executing a wire transfer to a Wells Fargo account, you're essentially instructing your bank to send a specific amount of money to a designated Wells Fargo account. This is done electronically, ensuring quick delivery.

Transferring funds via wire to Wells Fargo provides several benefits. Firstly, it's fast, often delivering funds within the same business day. Secondly, it’s secure, with multiple layers of verification protecting the transaction. Thirdly, it’s reliable, offering a consistent and dependable method for moving money, particularly for large sums.

To send a wire to Wells Fargo, you’ll need the recipient's full name and address, their Wells Fargo account number, the Wells Fargo routing number (for domestic transfers) or SWIFT code (for international transfers), and the amount you wish to transfer. Contact your bank to initiate the process and provide the required information.

Advantages and Disadvantages of Sending a Wire to Wells Fargo

| Advantages | Disadvantages |

|---|---|

| Speed | Cost |

| Security | Irreversibility |

| Reliability | Potential for Delays (with incorrect information) |

Best practices include double-checking all recipient information, understanding the associated fees, initiating transfers during business hours for faster processing, keeping your transfer confirmation information, and contacting your bank immediately if you encounter any issues.

Frequently Asked Questions:

1. How long does a wire transfer to Wells Fargo take? Typically, within the same business day.

2. What information do I need to send a wire to Wells Fargo? Recipient's name, address, account number, routing/SWIFT code, and transfer amount.

3. How much does it cost to send a wire to Wells Fargo? Contact your bank for fee information.

4. Can I cancel a wire transfer? Contact your bank immediately; cancellation may be possible if the transfer hasn't been processed.

5. Is it safe to send a wire transfer to Wells Fargo? Yes, wire transfers are secure with multiple layers of verification.

6. How do I track a wire transfer to Wells Fargo? Contact your bank for tracking information.

7. What do I do if my wire transfer is delayed? Contact your bank to investigate the delay.

8. Can I send a wire transfer to Wells Fargo internationally? Yes, using the appropriate SWIFT code.

Tips and tricks for a smooth wire transfer: Always double-check recipient information, initiate the transfer during business hours for faster processing, and keep your confirmation information safe.

In conclusion, sending a wire transfer to Wells Fargo is a reliable and efficient way to move funds, especially larger sums. While there are fees involved, the speed and security often outweigh the cost. By understanding the process, gathering the correct information, and following best practices, you can ensure a smooth and successful transfer. Remember to always double-check recipient details, initiate transfers during business hours, and keep your confirmation information secure. With the information provided in this guide, you should be well-equipped to handle your next wire transfer to Wells Fargo with confidence. If you have further questions, it's always best to contact your financial institution or Wells Fargo directly for the most up-to-date and accurate information. Taking the time to plan and understand the process will save you time and potential headaches in the long run.

Unlocking electrical simplicity the normally closed relay schematic symbol

Fixing your timepiece wall clock repair guide

Unleash your creativity pokemon coloring pages