Decoding Wells Fargo Wire Transfer Addresses

Ever found yourself staring blankly at a Wells Fargo wire transfer form, wondering exactly what information goes where? You're not alone. Navigating the world of wire transfers can feel like entering a secret code, especially when it comes to getting the address details right. This guide is your decoder ring, designed to demystify the process and make your next wire transfer smooth and successful.

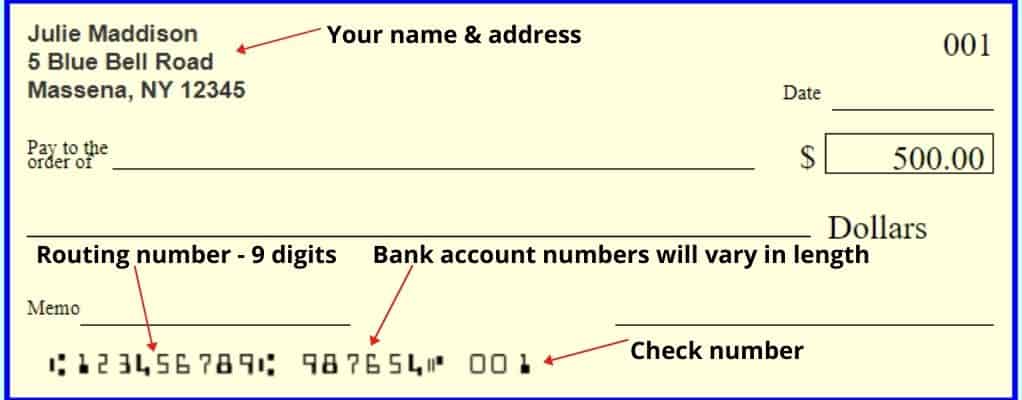

So, what exactly constitutes a Wells Fargo wire transfer "address"? It's more than just a street address. It's a collection of information that pinpoints the exact destination of your funds. This typically includes the recipient's name, account number, Wells Fargo's SWIFT code (for international transfers), and potentially the bank's physical address. Getting any piece wrong can lead to delays, returned funds, or even lost money.

The need for precise information stems from the nature of wire transfers themselves. Unlike checks or electronic transfers, wire transfers are real-time transactions, moving money directly from one account to another almost instantaneously. This speed and finality make them ideal for large sums or time-sensitive payments. However, this also means there’s little room for error. Historically, wire transfers were primarily used for large business transactions, but with increasing globalization and digital banking, they've become more common for individuals too.

One of the main issues surrounding Wells Fargo wire transfer addresses, and wire transfers in general, is security. Because of the immediacy of the transaction, it’s crucial to ensure the recipient's details are absolutely correct. Sending money to the wrong account can be a nightmare to rectify. This concern underscores the importance of double and triple-checking all the information before initiating a transfer.

Another challenge involves finding the correct Wells Fargo routing and SWIFT codes. While your account number is specific to you, the routing and SWIFT codes are specific to Wells Fargo. The routing number identifies the bank within the US, while the SWIFT code is used for international transfers. These codes are readily available on the Wells Fargo website, your bank statements, or by contacting customer service.

Getting the Wells Fargo wire transfer information right is essential for a successful transfer. Ensure the recipient provides you with their full name, accurate account number, and the correct Wells Fargo details. Double-check everything before submitting the transfer.

Three key benefits of using accurate wire transfer information include: successful and timely completion of the transfer, avoiding potential delays or returned funds, and enhanced security by ensuring your money goes to the intended recipient.

Advantages and Disadvantages of Wire Transfers

| Advantages | Disadvantages |

|---|---|

| Speed and efficiency | Cost (typically higher than other transfer methods) |

| Ideal for large sums | Irreversible nature |

| International capabilities | Potential for fraud if information is incorrect |

Best Practices for Wells Fargo Wire Transfers

1. Verify recipient information: Always double-check the recipient’s name, account number, and bank details.

2. Use secure channels: Initiate wire transfers through secure online banking platforms or at a Wells Fargo branch.

3. Keep records: Retain copies of all wire transfer confirmations.

4. Be wary of scams: Never send money to someone you don’t know or trust.

5. Contact customer service: If you have any questions or concerns, reach out to Wells Fargo customer service.

Frequently Asked Questions

1. Where can I find my Wells Fargo routing number? - Check your bank statement, online banking, or contact customer service.

2. What is a SWIFT code? - A SWIFT code is used for international wire transfers and identifies the recipient's bank.

3. How long does a wire transfer take? - Domestic transfers are often completed the same day, while international transfers can take a few business days.

4. What are the fees for wire transfers? - Fees vary depending on the type and destination of the transfer.

5. Can I cancel a wire transfer? - Contact Wells Fargo immediately. Cancellation may be possible if the transfer hasn't been processed yet.

6. Is online banking secure for wire transfers? - Wells Fargo's online banking platform employs security measures to protect your transactions.

7. What do I do if I made a mistake on the wire transfer information? - Contact Wells Fargo immediately.

8. How do I track my wire transfer? - You can usually track the status of your wire transfer through your online banking platform.

Tips and Tricks: Always review the transfer details before submitting. Consider setting up transfer limits for added security. Save frequently used recipient information for future transfers.

In conclusion, navigating the intricacies of Wells Fargo wire transfer addresses can feel daunting, but armed with the right information and a careful approach, it doesn't have to be. Understanding what constitutes a "wire transfer address," verifying recipient details, and following best practices are crucial for successful and secure transactions. By prioritizing accuracy and security, you can leverage the speed and efficiency of wire transfers for your financial needs. Remember to always double-check the information, use secure channels, and contact Wells Fargo customer service if you have any questions. Taking these steps will empower you to use wire transfers confidently and effectively.

Willard correctional facility inmate search decoded

Decoding janet c malones part rules a comprehensive guide

Conquer the gorilla skull easy drawing guide