Decoding the Wells Fargo Wire Transfer

Okay, so let's talk money. Specifically, the sometimes intimidating but undeniably useful world of wire transfers. Ever needed to send money across state lines, or even across an ocean, like, *fast*? Then you've probably encountered the need for a wire transfer. This isn't your Venmo request for brunch – we're talking serious, often large sums of money moving swiftly through the financial ether. Today, we're dissecting the Wells Fargo wire transfer process, breaking it down into digestible, bite-sized pieces.

Sending money via wire transfer with Wells Fargo, like choosing the right shade of lipstick, requires a certain level of know-how. You wouldn't just swipe on any old color without considering your skin tone, right? Similarly, you want to understand the nuances of wire transfers before hitting send on a substantial sum. This guide will walk you through the essential steps, fees, and everything else you need to know to confidently navigate a Wells Fargo wire transfer, whether you're sending funds domestically or internationally.

Wire transfers have a long and surprisingly complex history. They predate the internet and even the telephone, initially relying on telegraph networks. Imagine that – your money essentially being sent as a coded message! While the technology has obviously evolved, the basic principle remains the same: a near-instantaneous electronic transfer of funds between banks. With Wells Fargo, you can initiate a wire transfer through online banking, by phone, or by visiting a branch, making the process remarkably convenient in today's fast-paced world.

Executing a Wells Fargo wire transfer involves providing specific information, such as the recipient's name, bank account number, and their bank's routing number (for domestic transfers) or SWIFT code (for international transfers). Accuracy is paramount here, as even a small error can cause delays or even send the funds to the wrong account. Think of it like addressing a letter – one wrong digit and your heartfelt missive ends up in Boise instead of Brooklyn. Not ideal.

One key aspect of understanding how to send a wire with Wells Fargo is understanding the associated fees. Like any good service, wire transfers come with a price tag, which can vary depending on whether the transfer is domestic or international and whether it's initiated online, by phone, or in person. Knowing these costs upfront will prevent any unexpected surprises and allow you to budget accordingly. So, let's dive into the nitty-gritty, shall we?

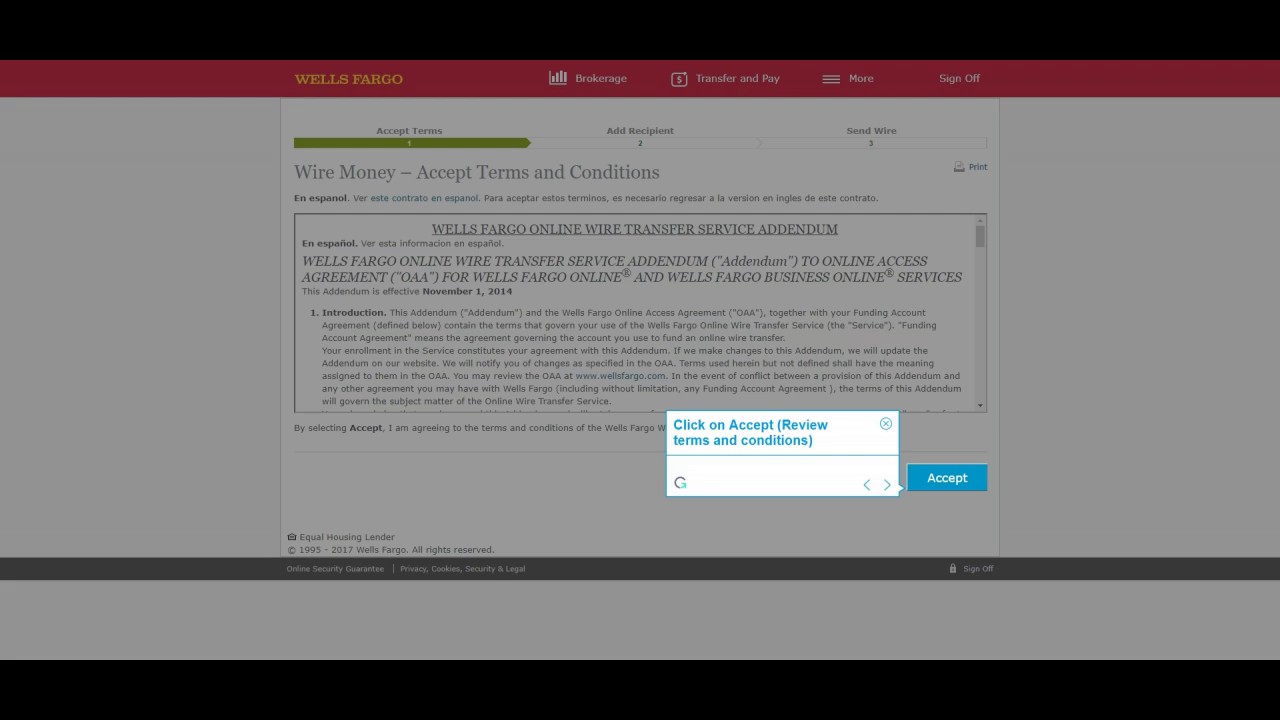

Initiating a wire transfer through Wells Fargo online requires logging into your account and navigating to the wire transfer section. You'll need to have the recipient's banking details readily available. For in-person transfers, you'll need to visit a Wells Fargo branch with the necessary information. Phone transfers involve contacting customer service and providing the required details.

Benefits of using Wells Fargo for wire transfers include the bank's extensive network, its established security measures, and its convenient online banking platform. Being able to manage your finances and initiate transfers digitally simplifies the process significantly.

Advantages and Disadvantages of Wells Fargo Wire Transfers

| Advantages | Disadvantages |

|---|---|

| Established and trusted bank | Fees can be higher than other methods |

| Multiple ways to initiate transfers (online, phone, in-person) | Requires precise recipient information |

| Extensive branch network | Can be subject to delays |

Best Practices: Always double-check recipient information, be aware of cutoff times for same-day transfers, keep records of your transfer confirmations, understand the fees associated with your transfer type, and if sending internationally, be aware of currency exchange rates.

FAQs:

What information do I need to send a wire transfer with Wells Fargo? (Recipient name, account number, bank routing/SWIFT code)

How much does a Wells Fargo wire transfer cost? (Varies based on transfer type)

How long does a Wells Fargo wire transfer take? (Typically within one business day, but can vary)

Can I cancel a Wells Fargo wire transfer? (Possibly, if it hasn't been processed yet)

How do I track a Wells Fargo wire transfer? (Through your online banking account or by contacting customer service)

Is it safe to send a wire transfer with Wells Fargo? (Wells Fargo employs security measures to protect your transactions)

What are the Wells Fargo wire transfer limits? (Vary depending on your account type and transfer method)

Can I send a wire transfer internationally with Wells Fargo? (Yes)

So, in conclusion, navigating the world of Wells Fargo wire transfers doesn't have to be daunting. Understanding the process, being prepared with the correct information, and following best practices can empower you to manage your finances efficiently and send money where it needs to go quickly and securely. While fees and potential delays are factors to consider, the convenience and reliability of wire transfers often make them the ideal solution for time-sensitive or large-sum transactions. Remember to stay informed about Wells Fargo's specific policies and fees, and don't hesitate to reach out to their customer service team if you have any questions. Knowing your options and taking control of your financial flow is always a good look.

Finding peace with sherwin williams standard white paint

Brewing success starbucks gift cards for corporate gifting

Behr battleship gray paint the ultimate guide