Decoding Gross Income: A Comprehensive Guide

Ever wonder where your paycheck disappears to so quickly? Before taxes, deductions, and expenses take their bite, there's a crucial figure to understand: your gross income. This fundamental financial concept is the starting point for understanding your earnings and managing your money effectively. "Apa itu pendapatan kasar?" translates from Indonesian to "What is gross income?" in English, and it's a question worth exploring in detail.

Gross income, in its simplest form, represents the total amount of money you earn before any deductions. Think of it as the raw, untouched sum of your earnings from various sources, including salaries, wages, profits from a business, interest earned, dividends, rental income, and even royalties. It's the top-line number, the foundation upon which your financial health is built. Understanding this figure is the first step towards building a solid financial future.

While the precise origins of the term "gross income" are difficult to pinpoint, the concept of tracking earnings has existed for centuries. As commerce and trade evolved, so did the need to record income for taxation and accounting purposes. The modern understanding of gross income is crucial for both individual financial planning and macroeconomic analysis. Governments use aggregate gross income data to understand economic trends, while individuals use it to budget, save, and invest.

The importance of understanding your gross income cannot be overstated. It serves as the bedrock for calculating your net income (what you take home after deductions), tax liabilities, and eligibility for various financial products like loans and mortgages. It's the key metric used by lenders to assess your borrowing capacity and by financial advisors to create personalized financial plans. Misunderstanding or miscalculating your gross income can lead to inaccurate budgeting, unexpected tax burdens, and difficulty securing financial assistance when needed.

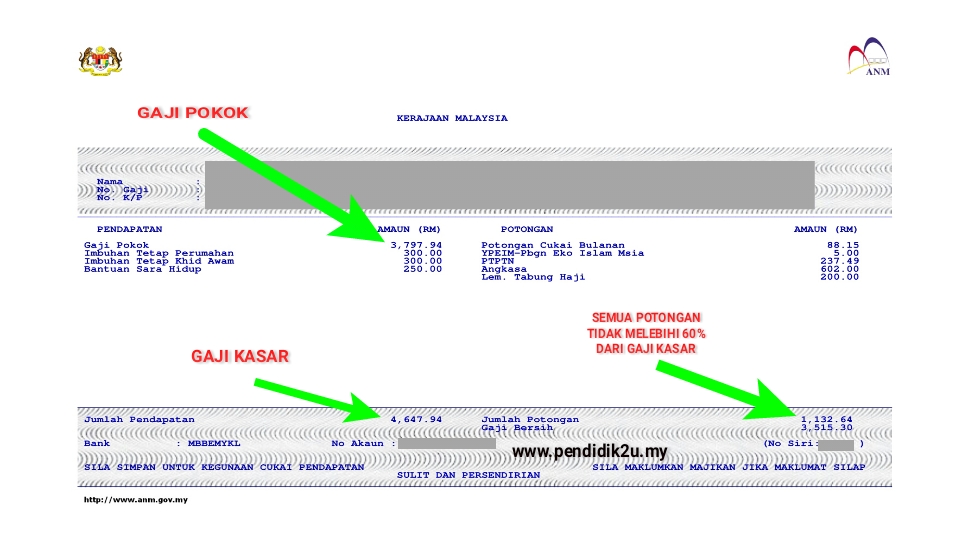

One of the primary issues related to gross income is accurately tracking and reporting it. For salaried employees, this is relatively straightforward as employers typically provide detailed payslips. However, for self-employed individuals, freelancers, or those with multiple income streams, it can be more complex. Accurate record-keeping is essential to avoid issues with tax authorities and ensure a clear understanding of one’s financial standing. This might involve utilizing accounting software, consulting with a financial professional, or meticulously tracking income from all sources.

For example, if you earn a salary of $50,000 per year and receive $5,000 in dividends from investments, your gross income is $55,000. This is the figure you would report as your gross income, even before taxes and other deductions are applied.

One benefit of understanding your gross income is improved budgeting. With a clear understanding of your total earnings, you can create a realistic budget that accounts for expenses, savings goals, and debt repayment. Another benefit is accurate tax planning. Knowing your gross income allows you to estimate your tax liability and take steps to minimize it through legal deductions and credits. Finally, understanding your gross income empowers you to make informed financial decisions, from negotiating salary increases to choosing the right investment strategies.

To create an action plan for managing your gross income effectively, start by tracking all your income sources meticulously. Then, create a detailed budget that aligns with your financial goals. Finally, regularly review and adjust your budget as needed. A successful example would be someone who tracks their income using a budgeting app, allocates a percentage for savings and investments, and regularly reviews their progress to ensure they are on track to meet their financial goals.

Advantages and Disadvantages of Focusing on Gross Income

| Advantages | Disadvantages |

|---|---|

| Clearer understanding of overall earnings | Doesn't reflect actual take-home pay |

| Better budgeting and financial planning | Can lead to overestimation of spending capacity |

| More accurate tax planning | Doesn't account for variations in deductions |

Frequently Asked Questions:

1. What is the difference between gross and net income? Gross income is your total earnings before deductions, while net income is what you take home after taxes and other deductions.

2. How is gross income calculated? It's calculated by adding up all your income sources, including salaries, wages, investment income, and other earnings.

3. Why is gross income important? It's crucial for budgeting, tax planning, and assessing your overall financial health.

4. How often should I review my gross income? At least annually, or whenever there's a significant change in your income.

5. What are some common deductions from gross income? Taxes, retirement contributions, health insurance premiums, and other deductions specified by your employer or applicable tax laws.

6. How can I increase my gross income? By seeking a raise, pursuing additional income streams, or improving your skills and qualifications.

7. Where can I find more information about managing my gross income? Consult with a financial advisor or explore reputable financial websites and books.

8. What tools can help me track my gross income? Budgeting apps, spreadsheets, or accounting software.

In conclusion, understanding "apa itu pendapatan kasar," or what is gross income, is a foundational element of financial literacy. From accurate budgeting and tax planning to securing loans and making informed investment decisions, your gross income plays a pivotal role in shaping your financial future. By actively tracking, managing, and understanding your gross income, you empower yourself to take control of your finances, achieve your financial goals, and build a more secure financial future. Take the time to review your income statements, explore available financial resources, and seek professional guidance if needed. Your financial well-being will thank you for it.

Bugged out insects rule the animal kingdom

Free funny friday evening images a guide to german weekend cheer

Unlocking hudson county records your guide to the online registers office