Cancel Your Credit Card the Right Way Requesting Credit Card Cancellation in Writing

Ready to ditch that plastic? Closing a credit card account might seem simple, but doing it right is crucial. A formal written request, or credit card cancellation letter, is the most secure and effective method. This approach offers a clear paper trail, minimizing potential issues and ensuring a smooth cancellation process.

Why bother with a letter when you can just call? While phone cancellations are convenient, a written request provides concrete proof of your intention to close the account. This can protect you from unauthorized charges, billing errors, and potential damage to your credit score. Think of it as an insurance policy for your financial health.

The practice of writing formal cancellation letters for financial accounts has existed for decades, evolving alongside the credit card industry. Originally, written communication was the primary means of managing accounts, and this tradition continues to be a reliable method for ensuring clarity and accountability. With the rise of digital communication, email might seem faster, but a physical letter holds significant weight and provides a stronger legal record.

One of the main issues surrounding credit card cancellation is the lack of awareness about the importance of formal written requests. Many individuals rely solely on phone calls or online portals, leaving themselves vulnerable to potential complications. A well-structured letter eliminates ambiguity and provides a documented timeline of your request, safeguarding you against future disputes.

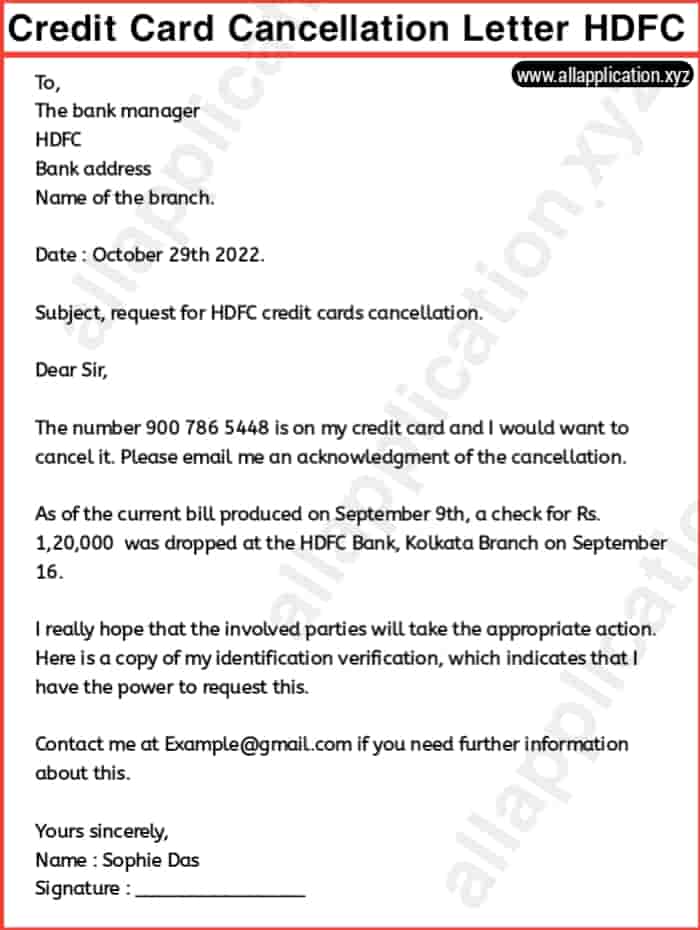

A credit card cancellation letter format is straightforward. It should include your account number, the date you want the card closed, your contact information, and a clear statement of your intention to cancel the card. You should also request confirmation of the cancellation in writing. Keeping a copy of the sent letter for your records is essential.

One key benefit of using a formal letter is the undeniable proof it provides. This can be crucial in resolving any discrepancies or disputes that may arise. For example, if you're charged after the supposed cancellation date, your letter serves as concrete evidence of your request.

Another advantage is the clarity it offers. A written request leaves no room for misinterpretation or miscommunication. You explicitly state your intention, leaving no doubt about your desired action.

Finally, a letter offers a greater sense of control over the process. You dictate the terms and timeline, ensuring your request is handled properly. This avoids potential delays or misunderstandings that can occur with verbal communication.

To cancel your card effectively, follow these steps: Gather your account information, draft your letter, send it via certified mail with return receipt requested, and keep a copy for your records. Successfully closing a credit card account this way leaves you with peace of mind and a clean financial slate.

Advantages and Disadvantages of Written Credit Card Cancellation

| Advantages | Disadvantages |

|---|---|

| Provides a clear paper trail | Slower than phone or online methods |

| Minimizes potential for disputes | Requires more effort |

| Ensures a smooth cancellation process | Relies on postal service |

Best Practices:

1. Always send your letter via certified mail.

2. Keep a copy of the letter for your records.

3. Follow up with a phone call to confirm receipt.

4. Check your credit report to ensure the account is closed.

5. Destroy your physical card.

FAQ:

1. Q: Why should I send a letter? A: It provides legal proof of your cancellation request.

2. Q: What information should I include? A: Account number, date of cancellation request, contact info.

3. Q: How should I send the letter? A: Certified mail with return receipt requested.

4. Q: What if I don't receive confirmation? A: Follow up with the credit card company.

5. Q: Can I cancel online? A: Yes, but a letter is recommended for stronger documentation.

6. Q: What if I have outstanding balance? A: You must pay off the balance before cancelling.

7. Q: How long does the cancellation process take? A: Typically a few business days.

8. Q: What should I do with my old card? A: Cut it up and dispose of it securely.

Tips and Tricks: Consider cutting up your card immediately after sending the letter. This reinforces your intent and minimizes the temptation to use it.

In conclusion, canceling your credit card through a formal written request offers a secure and effective approach. While other methods exist, a letter format for credit card cancellation offers undeniable proof of your intention, protecting you from potential complications and disputes. This method may require a bit more effort, but the peace of mind and financial security it provides are invaluable. By following the steps outlined above, you can confidently close your account and maintain a healthy credit history. Take control of your finances and choose the method that offers the highest level of protection and clarity. Don't just close your account; close it the right way. Implement these best practices to ensure a smooth and hassle-free experience. A proactive approach to credit card management is essential for long-term financial well-being. Embrace the power of a well-crafted letter and safeguard your financial future. Remember, your financial security is worth the extra effort.

Unleash your inner designer top benjamin moore green paints

Unlock serenity with sea haze the ultimate guide to benjamin moore 2137 50

Crafting a compelling donation stand a guide to maximizing your impact