California State Payday Schedule: A Comprehensive Guide

Managing your finances effectively hinges on understanding your pay schedule. For California state employees, knowing the intricacies of the California state payday calendar is crucial. This comprehensive guide will explore everything you need to know about California state paydays, ensuring you're always prepared.

California's state government employs a vast workforce across various departments and agencies. Each employee, from highway patrol officers to administrative staff, relies on a consistent and predictable pay schedule. Understanding the California state payroll calendar enables employees to budget effectively, plan for expenses, and avoid financial surprises. This involves knowing not just the payday itself, but also the pay period covered and any potential variations due to holidays or weekends.

The history of structured paydays within the California state government reflects a broader shift towards formalized employment practices. While precise historical details on the evolution of the specific California state payroll schedule are scarce, its development mirrors the increasing need for standardized systems in managing large workforces. This structure ensures fair and timely compensation for all employees, contributing to a stable and productive work environment.

The California state payday calendar is of paramount importance for a multitude of reasons. Firstly, it provides transparency and predictability for state employees. Knowing exactly when their paychecks will arrive empowers them to manage their finances responsibly. Secondly, it plays a crucial role in maintaining employee morale and job satisfaction. Timely and accurate payment is a fundamental aspect of a positive work experience. Thirdly, the established pay calendar allows for efficient budgeting and resource allocation within the state government itself, streamlining financial operations.

One of the most common questions surrounding the California state payday schedule revolves around holidays. If a payday falls on a holiday, the payment is typically disbursed on the preceding business day. This ensures employees still receive their pay in a timely manner despite the holiday observance. Specifics regarding holiday adjustments are usually communicated through official state channels and employee handbooks.

While a specific origin date for the CA state payday calendar is difficult to pinpoint, its importance is undeniable. It provides a framework for consistent and predictable pay, fostering financial stability for state employees. Its structured nature also facilitates accurate budgeting and planning at both the individual and governmental levels.

Understanding your California State payroll schedule allows for better financial planning. You can anticipate your income and time your bill payments accordingly. For example, if you know your California State payday is on the 15th of the month, you can schedule your rent or mortgage payment to be debited after that date.

Accurate knowledge of your pay schedule allows for better budgeting. By knowing exactly when funds will be available, you can create a more realistic budget and avoid overspending. A clear understanding of the pay periods allows for better tracking of earnings and deductions, making tax season preparations easier.

Being aware of your pay schedule and the pay period covered helps identify any discrepancies or payroll errors. If the amount received doesn't match the expected pay for the designated period, you can promptly address the issue with the relevant payroll department. This proactiveness prevents further complications and ensures you receive the correct compensation.

Accessing your specific pay schedule often involves logging into the state employee portal or contacting your department's HR representative. Information about payday schedules is also sometimes available on the California State Controller’s Office website.

Tips for working effectively with the California State payroll calendar include marking paydays on your personal calendar, setting up automatic bill payments after payday, and regularly reviewing your pay stubs to ensure accuracy.

While the advantages of a structured pay calendar are clear, occasional challenges may arise. Delayed payments due to unforeseen system errors can cause financial hardship for employees. Effective communication and prompt resolution of such issues by the relevant authorities are crucial to minimizing the impact. Moreover, changes in payroll systems or schedules can create confusion. Clear and timely communication regarding such changes helps alleviate potential issues.

FAQ:

1. Where can I find the California State Payday Calendar? - Check your employee portal or your department’s HR representative.

2. What if my payday falls on a holiday? – Pay is typically issued on the preceding business day.

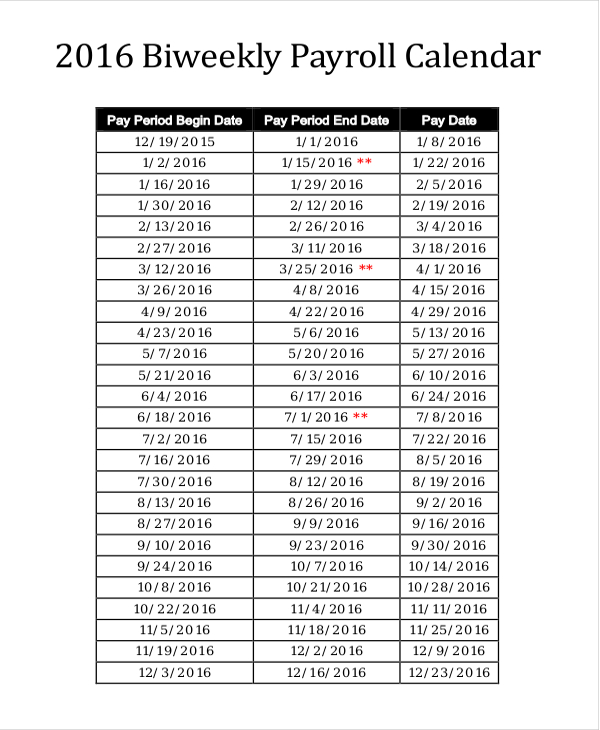

3. How are pay periods determined? - Pay periods are usually bi-weekly or monthly, depending on your employment classification.

4. Who do I contact for payroll issues? – Your departmental HR or the State Controller's Office.

5. Can I opt for direct deposit? – Yes, most state employees enroll in direct deposit.

6. How can I track my pay stubs? - Access your employee portal or contact HR.

7. Are there different pay schedules for different departments? - Not typically, although some variations might exist for specific roles.

8. How are overtime payments handled? - Overtime is generally included in the subsequent pay period.

In conclusion, the California state payday calendar plays a vital role in the financial well-being of state employees. Understanding its intricacies, including pay periods, holiday adjustments, and access to information, empowers employees to manage their finances effectively. By utilizing the tips and resources available, and staying informed about any updates, California state employees can maintain financial stability and plan for the future. The structured pay schedule offers transparency, predictability, and facilitates timely payment, contributing to a positive work environment and efficient government operations. Familiarize yourself with the calendar, track your pay, and contact the relevant authorities for any questions or concerns. This proactive approach will ensure you receive your compensation accurately and on time, empowering you to achieve your financial goals.

Decoding behr outdoor wood stain reviews

Exploring sk seksyen 24 shah alam a communitys educational heartbeat

Unlocking the art of chicano lettering